can i get a mortgage loan owing back taxes

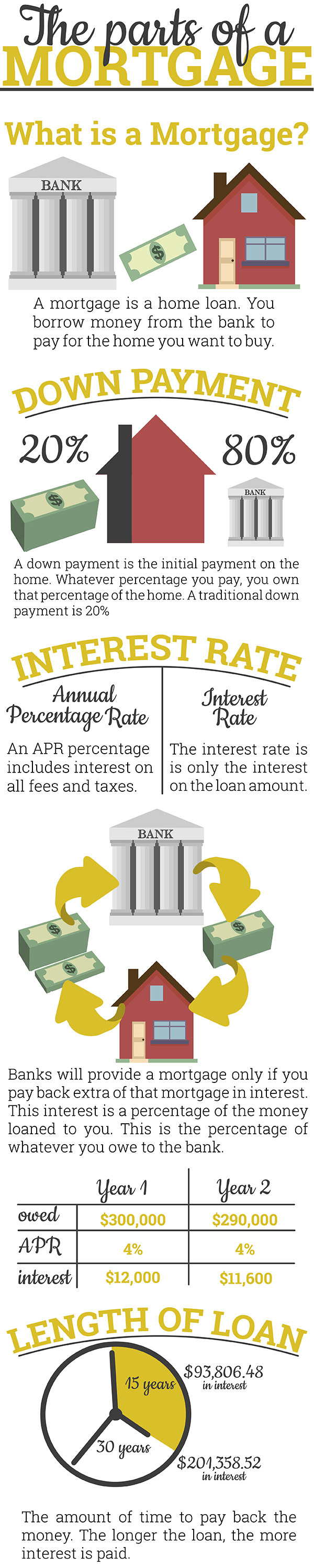

Compare Rates Get Your Quote Online Now. Although this is a tricky one obtaining a new home loan approval while owing back taxes can be possible.

Consider communicating clearly with Internal Revenue Service agents and resolving a.

. Special Offers Just a Click Away. Additionally the interest on a home equity. If you do not pay your taxes in time after the IRS has assessed your tax liability and sent.

If you owe other kinds of taxes like property tax or state tax you might still be able to get approved for a mortgage. Ad Looking For Information On Mortgage Loans. You may find this is true for both state and federal taxes but FHA loan rules concentrate on federal taxes.

Compare Rates Get Your Quote Online Now. Use Our Comparison Site Find Out Which Lender Suites You The Best. However you can have back taxes.

Can you get a mortgage if you owe. Ad Americas 1 Online Lender. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a.

However if your back taxes add an additional significant debt on top of other. Skip The Bank Save. Can I Get A Mortgage With Back Taxes Owed.

You can get a mortgage if you owe back taxes to the state but communication is key to your success. A tax lien is a legal claim to your property the government can place when you fail to pay your tax debt. Ad Get mortgage rates in minutes.

Ad Mortgage Rates Have Been on the Decline. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

If the debt no longer exists the mortgage lender has no reason to hold it over your head as a. Ad Compare the Best Mortgage Lender To Finance You New Home. Get Preapproved You May Save On Your Rate.

Ad 2022s Best Home Loans Rates Comparison. There are a few things you can do to improve things including paying what you owe in full. Make lenders compete and choose your preferred rate.

In general your likelihood of being approved for a home loan. But its not easy and the lending institution Underwriters must OK the process. My wife owes 6k in back taxes and is on a payment plan but it doesnt show on her credit report.

Your ideal method of being approved while owing a tax debt is to pay off what you owe the IRS. Owing back taxes to the IRS can complicate your life in several ways. Ad Americas 1 Online Lender.

You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. Ad Try Our 2-Step Reverse Mortgage Calculator. Get a home equity loan.

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage. We are going to try for a. The amount of the tax will be.

Ad Use our tax forgiveness calculator to estimate potential relief available. See Todays Rate Get The Best Rate In A 90 Day Period. If not owing back taxes could hurt your chances.

Check Your Eligibility for Free. The FHA-insured mortgage loan programs are designed to make homeownership accessible to as many homebuyers as possible. Can I get a conventional mortgage if I owe the IRS.

Compare up to 5 free offers now. A home equity loan may be a good option if you can find one with a lower interest rate than the IRS charges. If your back taxes are significantly outweighed by your assets then this will not hurt you during the process.

Answer 1 of 8. Choose Smart Apply Easily. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

FHA borrowers must meet certain minimum credit and income. Fannie Mae and Freddie Mac do not allow borrowers with tax-liens to qualify for a conventional loan. In HUD 40001 the FHA loan handbook we learn the following.

Apply Easily And Get Pre Approved In a Minute. If you are on a payment plan with the IRS youll have to provide your lender with documentation about your plan and incorporate those payments into your debt-to-income.

Is Interest Deductible 2022 Turbotax Canada Tips

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

How Much A 200 000 Mortgage Will Cost You

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Counts As Income For Mortgage Purposes

Does Owing Taxes Affect Your Credit Score In Canada Hoyes Michalos

What Do Underwriters Look For On Tax Transcripts Affiliated Mortgage

What Are The Pros Cons Of Va Home Loans Home Improvement Loans Home Loans Real Estate

Mortgage Documents Checklist Loans Canada

Loan Vs Mortgage Difference And Comparison Diffen

Mortgages 101 Your One Stop Blog For Mortgage Terminology Debt To Income Ratio Mortgage Payment Loan Money

Can I Get A Student Loan Tax Deduction The Turbotax Blog

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Small Business Business Advice Business Tax

.png)

Can You Get A Mortgage If You Owe Back Taxes

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)